Overnight, RealtyTrac released its latest home-flipping report. What it found is that while the latest housing bubble may have indeed popped, manifesting itself not only in a decline in flipping prices but also a tumble in flipping activity across the US as a percentage of all sales from 6.5% a year ago to just 3.7% in Q1, and down from 4.1% last quarter, flipping, where a home is purchased and subsequently sold again within six months, can still be massively profitable, leading to returns that would make the pimpliest 25-year-old, math PhD HFT-firm owner green with envy.

Overnight, RealtyTrac released its latest home-flipping report. What it found is that while the latest housing bubble may have indeed popped, manifesting itself not only in a decline in flipping prices but also a tumble in flipping activity across the US as a percentage of all sales from 6.5% a year ago to just 3.7% in Q1, and down from 4.1% last quarter, flipping, where a home is purchased and subsequently sold again within six months, can still be massively profitable, leading to returns that would make the pimpliest 25-year-old, math PhD HFT-firm owner green with envy.Among the core findings was that the average sales price of single family homes flipped in the first quarter was $55,574 higher than the average original purchase price. That gross profit provided flippers with an unadjusted ROI (return on investment) of 30 percent of the average original purchase price averaged out across the US. The average gross profit per flip a year ago was $51,805 for an unadjusted ROI of 28 percent. *However, it is the range that is notable: the flip ROI ranged from -8%, or a loss of $10k on the property, to a gain of 80%, a whopping $144K!*

What is just as notable is that while flipping across the US is moderating, in some states it is as high as 12% of all sales activity. And just as notable, in the first quarter a whopping 43% of all flipping sales were to an all-cash buyer - in other words, *flipping to other flippers*!

“Slowing home price appreciation early this year in many of the most popular flipping markets put some investors in danger of flying too close to the sun,” said Daren Blomquist, vice president at RealtyTrac. “But investors appear to have recalibrated their flipping strategy, accounting for the slower home price appreciation even if that means fewer flips."

This can be seen well on the chart below, which shows that while the average flipped price declined modestly to $239K across the US, the reason why the ROI surged is because the average purchase priced tumbled from roughly $240K to just $183K. What this means is that the flipping "sharks" are digging ever deeper into cheaper priced properties with hopes of holding to them then selling them, with or without renovations, to witless "dumber money."

Further breaking down the flipping trends by market, we see that buying just with an intention to sell is most dominant in Las Vegas, Phoenix, Miami, the Inland Empire and Los Angeles - all well known regions from the last housing bubble.

*Some of the other high-level findings of the report:*

· Flips completed in the first quarter took an average of 101 days to complete, up from an average of 92 days in the previous quarter and up from an average of 79 days for flips completed in the first quarter of 2013.

· Among metro areas with a population of at least 1 million and at least 25 single family homes flipped in the first quarter, those with the highest share of flips in the first quarter were New York (10.2 percent), Jacksonville, Fla., (10.0 percent), San Diego (7.1 percent), Las Vegas (6.7 percent) and Miami (5.9 percent).

· Among metro areas with a population of at least 1 million and at least 25 single family homes flipped in the first quarter, those with the highest average gross ROI percentage on single family homes flipped in the first quarter were Pittsburgh (89 percent), Philadelphia (56 percent), Memphis (51 percent), Detroit (48 percent), and Seattle (48 percent).

· Among those same major metros, those with the biggest increase from a year ago in home flipping as a share of all sales were San Antonio (up 52 percent), Nashville (up 50 percent), Indianapolis (up 47 percent), Austin (up 35 percent), Providence, R.I. (up 33 percent), and Oklahoma City (up 33 percent).

· Other major markets with year-over-year increases in flipping as a share of all sales included Los Angeles (up 1 percent), Dallas (up 28 percent), Seattle (up 19 percent), Houston (up 29 percent), and Portland (up 2 percent).

· Among major metros, those with the biggest decrease from a year ago in home flipping as a share of all sales were New Orleans (down 83 percent), Baltimore (down 81 percent), Minneapolis (down 80 percent), Richmond, Va. (down 80 percent), Detroit (down 76 percent), and Washington, D.C. (down 73 percent).

· Other major metros with year-over-year decreases in flipping as a share of all sales included New York (down 37 percent), Phoenix (down 39 percent), Riverside-San Bernardino in Southern California (down 22 percent), Atlanta (down 57 percent), Chicago (down 29 percent) and Las Vegas (down 9 percent).

· Among all metro areas nationwide those with the highest volume of flips in the first quarter were New York (1,791), Phoenix (894), Los Angeles (828), Miami (749), and Riverside-San Bernardino in Southern California (627).

· 82 percent of all properties flipped in the first quarter were sold to owner-occupants; 18 percent to buyers with a different mailing address than the property.

· 43 percent of all properties flipped in the first quarter were all-cash sales to the new buyer.

· 58 percent of all properties flipped in the first quarter were 3-bedroom homes, 21 percent 4 bedroom homes and 17 percent 2-bedroom homes.

Which brings us to the topic of the headline: where exactly does flipping generate a whopping 80% return on one's investment - nearly a doubling of the money - in under six months? The answer is shown on the chart below.

That's right: the place that is most likely to generate a massive return for flipping activity also happens to be one of the poorest cities in the US: Washington D.C. A city which, however, in addition to the poor social element is also home to the political social element. One wonders just how much of those flips are paid for by corrupt politicians paying in all cash. All taxpayer cash that is.

As an added bonus, here is a ranking of states sorted by prevalency of flipping activity. The top place should not come as a surprise to anyone - after all, those foreign billionaire oligarchs have to launder their illegally obtained cash somehow.

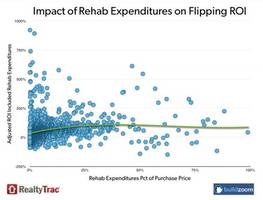

Finally, and perhaps most curiously, is a chart showing the impact of "rehab" spending, i.e. renovation costs, on the flipping ROI. Curious, because it is quite obvious that some of the biggest returns take place in homes in which the flipper doesn't put in even one cent of additional work, allowing returns of nearly 1000%. Alternatively, investing as much as the entire purchase price in "rehabiliation activity" provides absolutely no assurance that one will generate a significant return.

Bottom line: all of the above is merely a function of Fed monetary generosity. Anyone jumping into the ranks of the flippers should be aware that this, too, party is ending and very soon the flipper ROI is set to crash to 0% if not negative. Only when that happens will the housing bubble be well and truly on its way to a full blown, ahem, collapse. Reported by Zero Hedge 2 hours ago.